- The stock market's fear index sent mixed signals to investors this week, and that could be a sign that a bottom is near, according to Fundstrat.

- While the VIX often moves in the opposite direction of the stock market, both the VIX and S&P 500 fell on Thursday.

- "Every single instance was 'proximity to low' and 8 of 10 [times] at the low," Fundstrat's Tom Lee said.

The stock market's fear index is sending mixed signals to investors that suggest a bottom in the S&P 500 could be near, according to a Friday note from Fundstrat.

The Cboe Volatility index, known as the VIX, helps measure the level of fear among investors and has an inverse relationship with the broader stock market. That means when the stock market rises, the VIX usually falls, and vice versa.

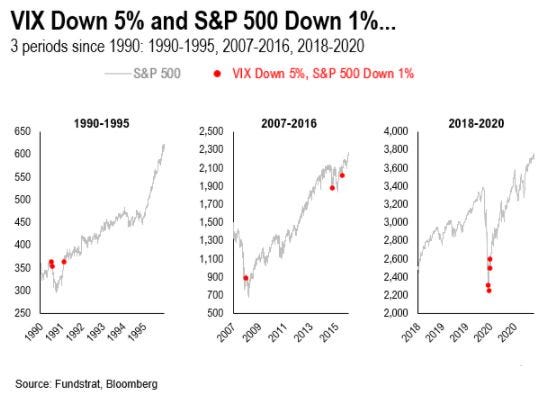

But on Thursday, the VIX fell 5% while the S&P 500 dropped 1%, sending a confusing signal to investors that could ultimately prove to be bullish for stocks, according to Fundstrat's Tom Lee.

Since the inception of the VIX in 1990, there have only been 10 instances when the VIX fell 5% on the same day the S&P 500 fell 1%. After those occurrences, the average forward six-month and 12-month return for the S&P 500 was 16.8% and 35.2%, respectively, according to Fundstrat.

"This is consistent with our view that 'one can't get hurt buying stocks here' even if there remains downside risk," Lee said in response to the data analysis.

Stocks were positive one year later 100% of the time, and were positive six months later 80% of the time.

And each time the VIX fell 5% on the same day the S&P 500 fell 1% the stock market was at or near an ultimate low.

"Every single instance was 'proximity to low' and 8 of 10 [times] at the low," Lee wrote.

If stocks do in fact reverse higher this month and make a low, it would mark yet another time the month of March proved to be an inflection point for the stock market. The Nasdaq peaked on March 10, 2000 during the dot-com bubble. The S&P 500 found its relative bottom on March 9, 2009 amid the Great Recession, and again on March 23, 2020 during the pandemic sell-off.